The recommendations must be approved by Hyde Commissioners before the budget is finalized, said County Manager Mazie Smith. They will likely make their decision at the April 30 meeting.

"I'm out at the field right now, envisioning the ball park," said Bill Rich, a member of the Recreational Field Committee. "We are very hopeful the county approves it as presented. That will give us the momentum to get the community involved," he said.

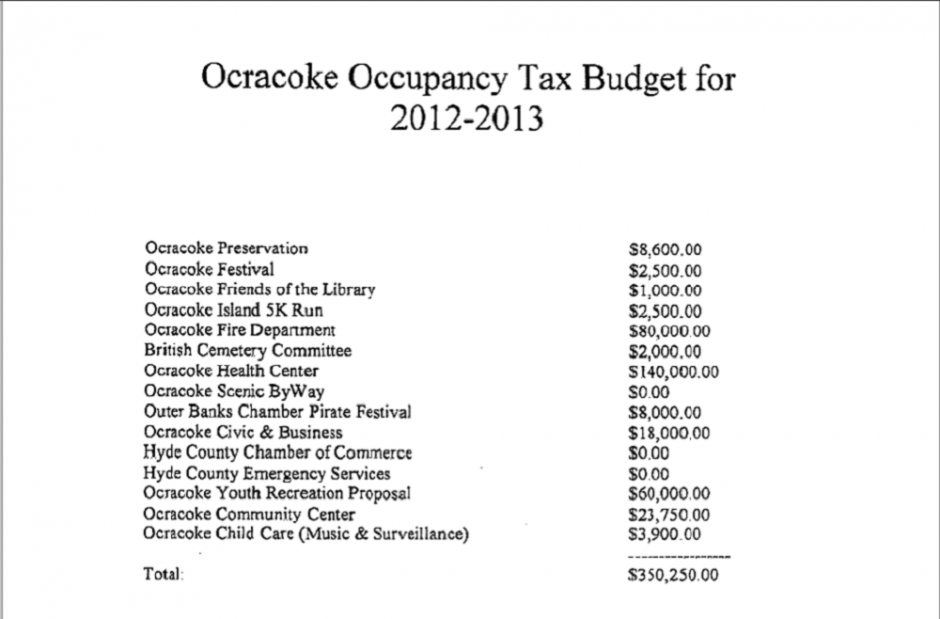

Since occupancy taxes were first collected 20 years ago, the board has saved over $450,000. They intend to always maintain a savings fund approximately equal to one year of revenues. Board member Wayne Clark said that fund was credit to the careful shepherding of longtime chair Stella O'Neal.

"Everyone on this board spends this money more conservatively than we spend our own money," Clark said.

The guiding legislation is generous in its breadth: "Hyde County may use the proceeds of the occupancy tax for any public purpose." 90% of the funds collected from hotel room, campsite and cottage rentals on Ocracoke are to be used "only for the direct benefit of the island." In most counties, the law directs occupancy tax funds to be used for promotion of tourism.

The current occupancy tax rate is 3%. Legislation passed in March 2006 allows the county to levy an additional 2% occupancy tax, specifying that 2/3 of the new funds be distributed by an "Ocracoke Township Tourism Development Authority," "to promote travel and tourism in the district and shall use the remainder for tourism-related expenditures in the district."

The commissioners have never voted to enact this additional tax.